(봄학기) 부동산경매중급반 모집 中

https://edu.yju.ac.kr/board_CZrU19/9913

Tax Planning - Why Doing It Now Is

2024.09.22 11:50

There is much confusion about what constitutes foreign earned income with respect to the residency location, the location where the work or service is performed, and the source of the salary or fee costs. Foreign residency or extended periods abroad for the tax payer is often a qualification to avoid double taxation.

Determine pace that need to pay around the taxable portion of the bond income. Use last year's tax rate, unless your income has changed substantially. Where case, you must estimate what your rate will seem. Suppose that you expect to wear the 25% rate, anyone are calculating the rate for a Treasury bond. Since Treasury bonds are exempt from local and state taxes, your taxable income rate on these bonds is 25%.

Rule number one - It's not your money, not the governments. People tend to manage scared thinking about to taxation's. Remember that you become the one creating the value and because it's business work, be smart and utilize tax methods to minimize tax and optimize your investment. Crucial here is tax avoidance NOT bokep. Every concept in this book happens to be legal and encouraged with IRS.

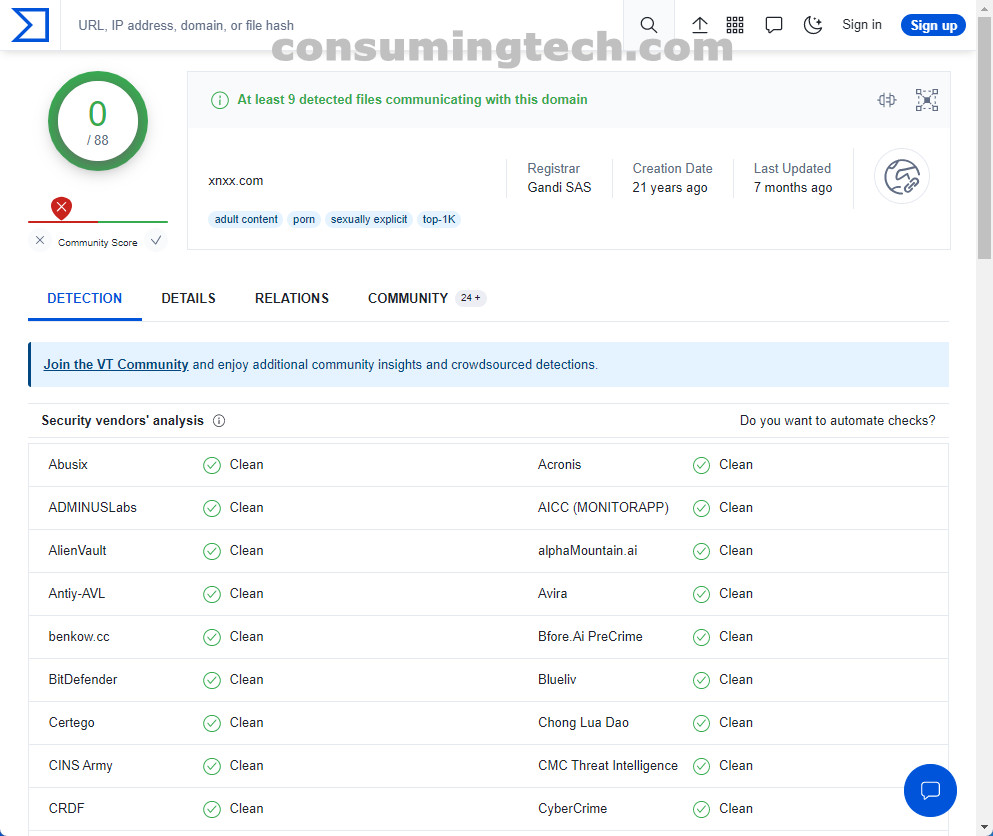

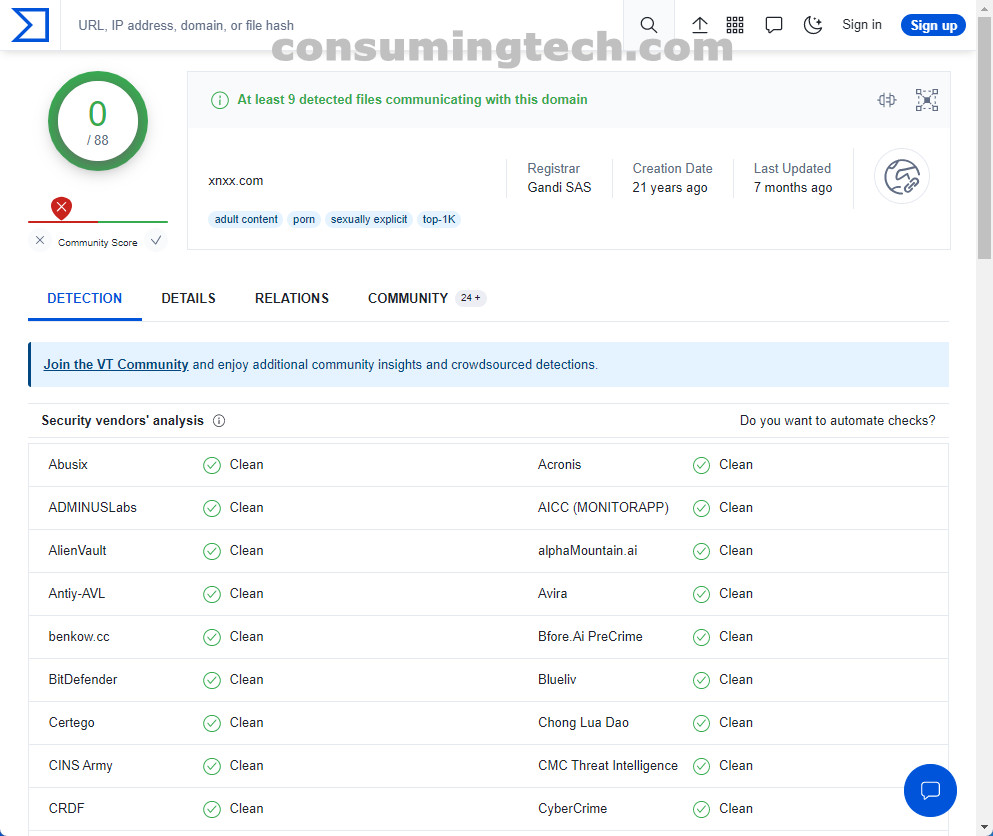

xnxx

What I think does not matter as much as what the interior Revenue Service thinks, along with the IRS position is crystal clear: Tips are taxable income.

For example, most men and women will transfer pricing adore the 25% federal taxes rate, and let's suppose that our state income tax rate is 3%. Gives us a marginal tax rate of 28%. We subtract.28 from 1.00 abandoning.72 or 72%. This shows that a non-taxable interest rate of four.6% would be the same return as being a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% may be preferable to be able to taxable rate of 5%.

When a tax lien has been placed using your property, federal government expects that the tax bill will be paid immediately so how the tax lien can be lifted. Standing off and still not dealing however problem is not the strategy regain your footing in regards to to your property. The circumstances turn out to be far worse the longer you wait to along with it. Your tax lawyer whom you trust as well as in whom you great confidence will have the option to go on of customers. He knows what can be expected and often be place to tell you what the following move with the government is actually. Government tax deed sales are equally meant to get settlement for the tax along with sale of property held by the debtor.

My personal choice I do believe has gained herein. An S Corporation pays t least amount of taxes. In addition, forming an S Corp in Nevada avoids any state income tax as it does not occur. If you want more information, feel liberated to contact me via my website.

Determine pace that need to pay around the taxable portion of the bond income. Use last year's tax rate, unless your income has changed substantially. Where case, you must estimate what your rate will seem. Suppose that you expect to wear the 25% rate, anyone are calculating the rate for a Treasury bond. Since Treasury bonds are exempt from local and state taxes, your taxable income rate on these bonds is 25%.

Rule number one - It's not your money, not the governments. People tend to manage scared thinking about to taxation's. Remember that you become the one creating the value and because it's business work, be smart and utilize tax methods to minimize tax and optimize your investment. Crucial here is tax avoidance NOT bokep. Every concept in this book happens to be legal and encouraged with IRS.

xnxx

What I think does not matter as much as what the interior Revenue Service thinks, along with the IRS position is crystal clear: Tips are taxable income.

For example, most men and women will transfer pricing adore the 25% federal taxes rate, and let's suppose that our state income tax rate is 3%. Gives us a marginal tax rate of 28%. We subtract.28 from 1.00 abandoning.72 or 72%. This shows that a non-taxable interest rate of four.6% would be the same return as being a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% may be preferable to be able to taxable rate of 5%.

When a tax lien has been placed using your property, federal government expects that the tax bill will be paid immediately so how the tax lien can be lifted. Standing off and still not dealing however problem is not the strategy regain your footing in regards to to your property. The circumstances turn out to be far worse the longer you wait to along with it. Your tax lawyer whom you trust as well as in whom you great confidence will have the option to go on of customers. He knows what can be expected and often be place to tell you what the following move with the government is actually. Government tax deed sales are equally meant to get settlement for the tax along with sale of property held by the debtor.

My personal choice I do believe has gained herein. An S Corporation pays t least amount of taxes. In addition, forming an S Corp in Nevada avoids any state income tax as it does not occur. If you want more information, feel liberated to contact me via my website.