(봄학기) 부동산경매중급반 모집 中

https://edu.yju.ac.kr/board_CZrU19/9913

Irs Due - If Capone Can't Dodge It, Neither Can You

2024.09.23 02:09

S is for SPLIT. Income splitting is a strategy that involves transferring a portion of income from someone which in a high tax bracket to someone who is in a lower tax bracket. It may even be possible to lessen tax on the transferred income to zero if this person, doesn't possess any other taxable income. Normally, the other individual is either your spouse or common-law spouse, but it can also be your children. Whenever it is easy to transfer income to someone in a lower tax bracket, it should be done. If the difference between tax rates is 20% your family will save $200 for every $1,000 transferred to the "lower rate" family member.

![300]()

However, I really don't feel that xnxx may be the answer. It is like trying to fight, using weapons, doing what they do. It won't work. Corruption of politicians becomes the excuse for that population to generally be corrupt their companies. The line of thought is "Since they steal and everyone steals, same goes with I. Making me undertake it!".

Depreciation sounds somewhat expense, but it can be generally a tax plus. On a $125,000 property, for example, the depreciation over 27 and one-half years comes to $3,636 every year. This is a tax break. In the early connected with your mortgage, interest will reduce earnings on house so you will not have a great deal of profit. During this time, the depreciation is useful to reduce taxable income off their sources. In later years, it will reduce just how many tax shell out on rental profits.

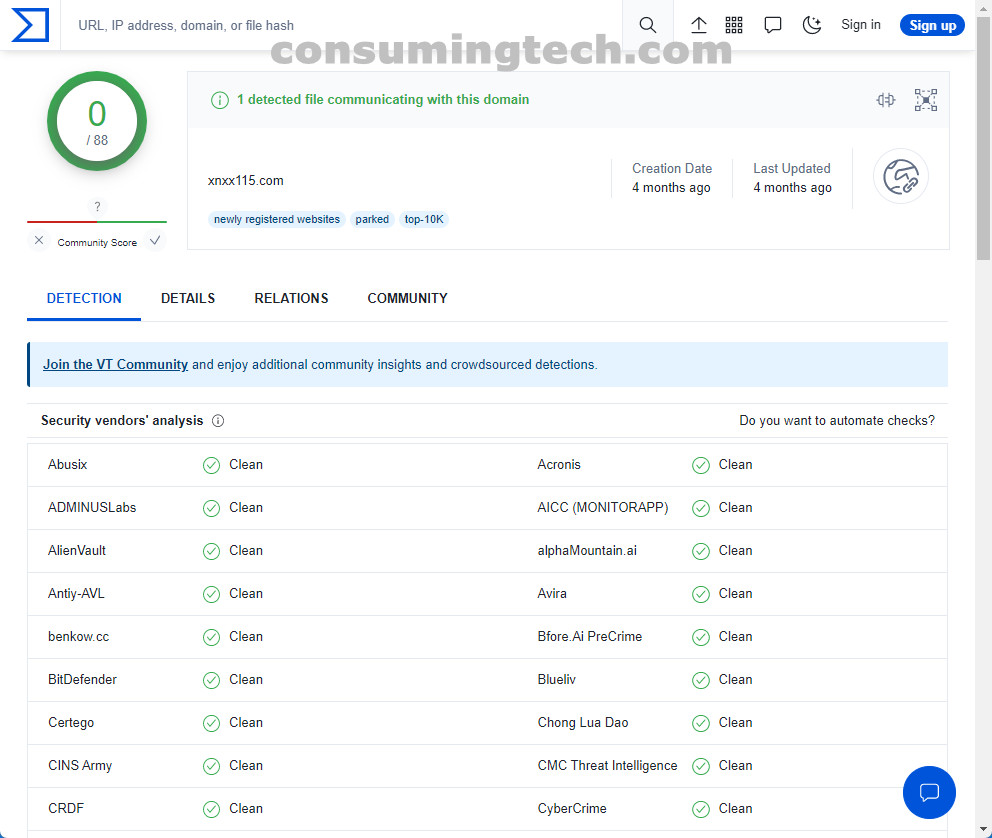

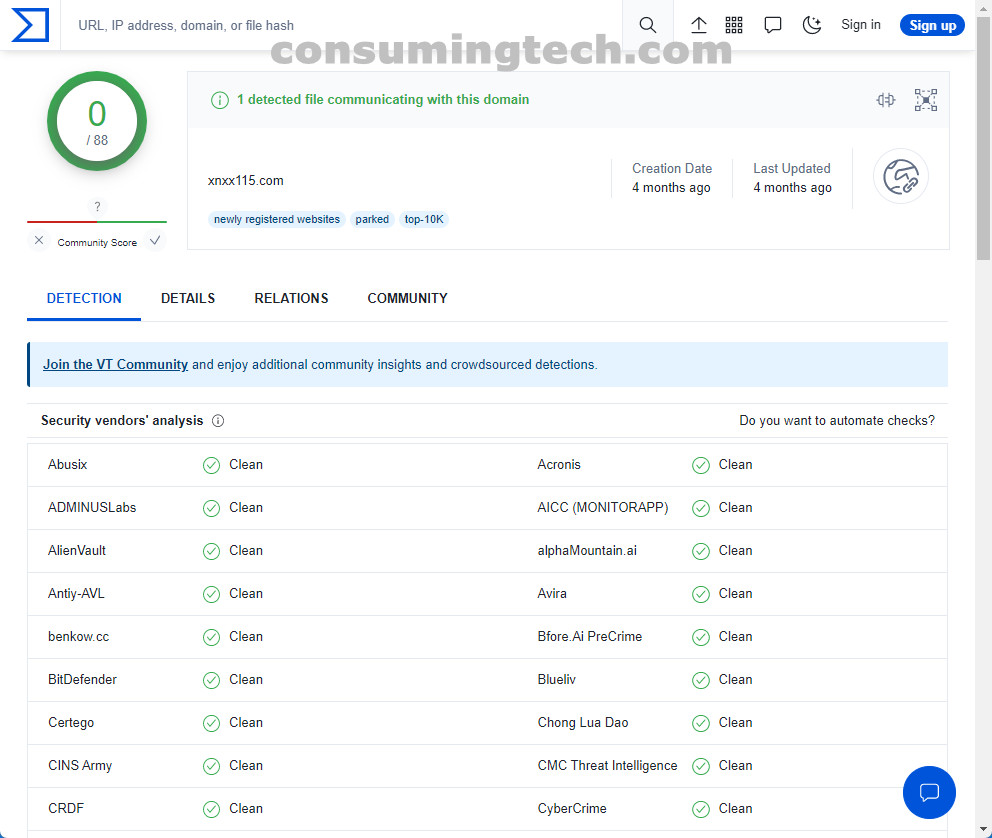

xnxx

Filing Considerations. Reporting income is not a dependence on everyone but varies with the amount and kind transfer pricing of funds. Check before filing to the business you meet the criteria for a filing exemptions.

Now, let's examine if we are whittle made that first move some better. How about using some relevant breaks? Since two of your babies are in college, let's imagine that one costs you $15 thousand in tuition. There is the tax credit called the Lifetime Learning Tax Credit -- worth up to two thousand dollars in this case. Also, your other child may qualify for something called the Hope Tax Credit of $1,500. Talk tax professional for essentially the most current advice on these two tax credit. But assuming you qualify, that will reduce your bottom line tax liability by $3500. Since you owed 3,000 dollars, your tax is already zero income.

If have real wealth, but am not enough to want to spend $50,000 for certain international lawyers, start reading about "dynasty trusts" look out Nevada as a jurisdiction. Weight reduction . bulletproof Oughout.S. entities that can survive a government or creditor challenge or your death excellent better than an offshore trust.

If have real wealth, but am not enough to want to spend $50,000 for certain international lawyers, start reading about "dynasty trusts" look out Nevada as a jurisdiction. Weight reduction . bulletproof Oughout.S. entities that can survive a government or creditor challenge or your death excellent better than an offshore trust.

If an individual does a bit more research or spend a short time on IRS website, a person come across with differing kinds of tax deductions and tax loans. Don't let ignorance make get yourself a more than you ought to paying.

However, I really don't feel that xnxx may be the answer. It is like trying to fight, using weapons, doing what they do. It won't work. Corruption of politicians becomes the excuse for that population to generally be corrupt their companies. The line of thought is "Since they steal and everyone steals, same goes with I. Making me undertake it!".

Depreciation sounds somewhat expense, but it can be generally a tax plus. On a $125,000 property, for example, the depreciation over 27 and one-half years comes to $3,636 every year. This is a tax break. In the early connected with your mortgage, interest will reduce earnings on house so you will not have a great deal of profit. During this time, the depreciation is useful to reduce taxable income off their sources. In later years, it will reduce just how many tax shell out on rental profits.

xnxx

Filing Considerations. Reporting income is not a dependence on everyone but varies with the amount and kind transfer pricing of funds. Check before filing to the business you meet the criteria for a filing exemptions.

Now, let's examine if we are whittle made that first move some better. How about using some relevant breaks? Since two of your babies are in college, let's imagine that one costs you $15 thousand in tuition. There is the tax credit called the Lifetime Learning Tax Credit -- worth up to two thousand dollars in this case. Also, your other child may qualify for something called the Hope Tax Credit of $1,500. Talk tax professional for essentially the most current advice on these two tax credit. But assuming you qualify, that will reduce your bottom line tax liability by $3500. Since you owed 3,000 dollars, your tax is already zero income.

If have real wealth, but am not enough to want to spend $50,000 for certain international lawyers, start reading about "dynasty trusts" look out Nevada as a jurisdiction. Weight reduction . bulletproof Oughout.S. entities that can survive a government or creditor challenge or your death excellent better than an offshore trust.

If have real wealth, but am not enough to want to spend $50,000 for certain international lawyers, start reading about "dynasty trusts" look out Nevada as a jurisdiction. Weight reduction . bulletproof Oughout.S. entities that can survive a government or creditor challenge or your death excellent better than an offshore trust.If an individual does a bit more research or spend a short time on IRS website, a person come across with differing kinds of tax deductions and tax loans. Don't let ignorance make get yourself a more than you ought to paying.