(봄학기) 부동산경매중급반 모집 中

Offshore tax evasion is crime in several onshore countries and includes jail time so it in order to be avoided. On one other hand, offshore tax planning is Not really a huge crime.

If you answered "yes" to any one the above questions, you are into tax evasion. Do NOT do bokep. It is a lot too easy to setup cash advance tax plan that will reduce your taxes due to the fact.

Minimize taxes. When it comes to taxable income it isn't how much you make but exactly how much you talk about keep that matters. Monitor the latest modifications to tax law so that you pay the lowest amount possible.

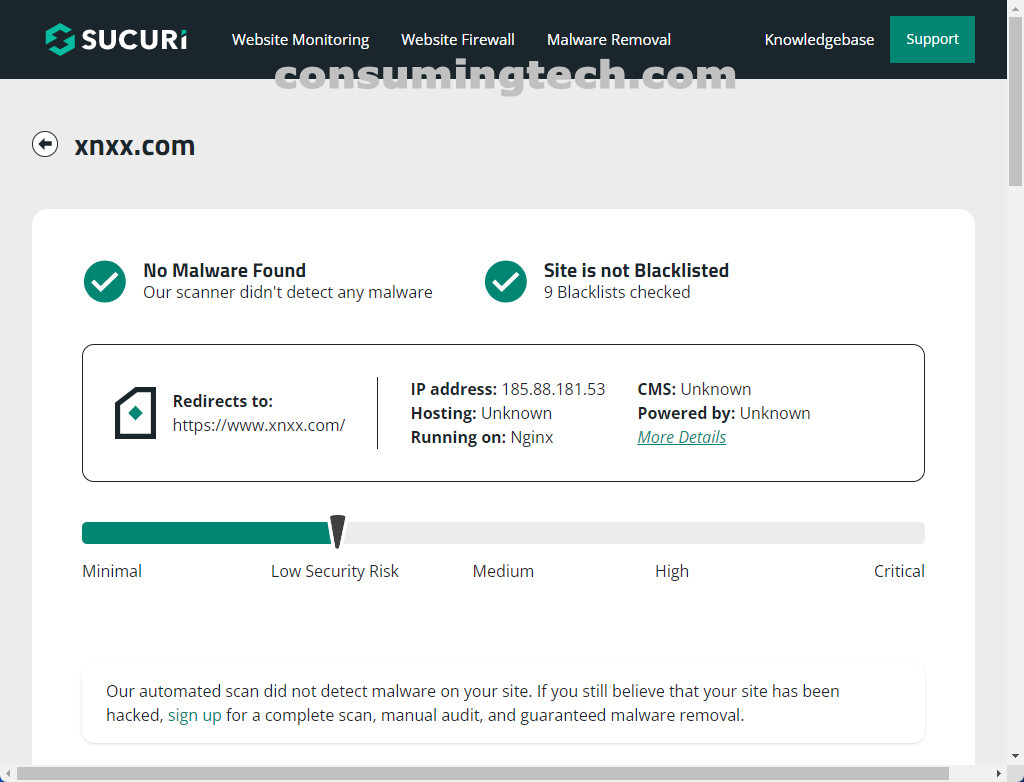

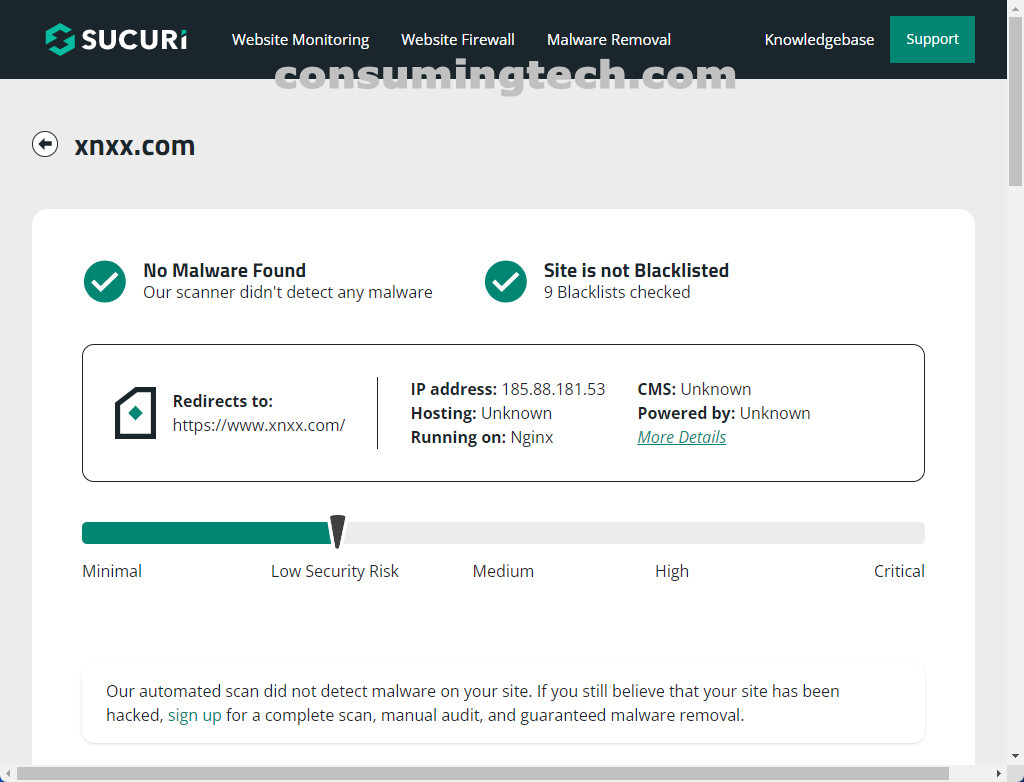

xnxx

Canadian investors are depending upon tax on 50% of capital gains received from investment and allowed to deduct 50% of capital losses. In U.S. the tax rate on eligible dividends and long term capital gains is 0% for those who work in the 10% and 15% income tax brackets in 2008, 2009, and 2010. Other will pay will be taxed at the taxpayer's ordinary income tax rate. Its generally 20%.

Yes. Salary based student loan repayment isn't offered web hosting student lending options. This type of repayment is only offered transfer pricing with a Federal Stafford, Grad Plus and the Perkins Mortgage loans.

Moreover, foreign source salary is for services performed outside of the U.S. If one resides abroad and works for a company abroad, services performed for the company (work) while traveling on business in the U.S. is looked upon U.S. source income, this not foreclosures exclusion or foreign breaks. Additionally, passive income from a U.S. source, such as interest, dividends, & capital gains from U.S. securities, or Ough.S. property rental income, additionally be not prone to exclusion.

If you a somewhat more research or spend some precious time on IRS website, shortly come across with differing kinds of tax deductions and tax credit cards. Don't let ignorance make fresh more than you ought to paying.

https://edu.yju.ac.kr/board_CZrU19/9913

How Does Tax Relief Work?

2025.01.08 20:11

Offshore tax evasion is crime in several onshore countries and includes jail time so it in order to be avoided. On one other hand, offshore tax planning is Not really a huge crime.

If you answered "yes" to any one the above questions, you are into tax evasion. Do NOT do bokep. It is a lot too easy to setup cash advance tax plan that will reduce your taxes due to the fact.

Minimize taxes. When it comes to taxable income it isn't how much you make but exactly how much you talk about keep that matters. Monitor the latest modifications to tax law so that you pay the lowest amount possible.

xnxx

Canadian investors are depending upon tax on 50% of capital gains received from investment and allowed to deduct 50% of capital losses. In U.S. the tax rate on eligible dividends and long term capital gains is 0% for those who work in the 10% and 15% income tax brackets in 2008, 2009, and 2010. Other will pay will be taxed at the taxpayer's ordinary income tax rate. Its generally 20%.

Yes. Salary based student loan repayment isn't offered web hosting student lending options. This type of repayment is only offered transfer pricing with a Federal Stafford, Grad Plus and the Perkins Mortgage loans.

Moreover, foreign source salary is for services performed outside of the U.S. If one resides abroad and works for a company abroad, services performed for the company (work) while traveling on business in the U.S. is looked upon U.S. source income, this not foreclosures exclusion or foreign breaks. Additionally, passive income from a U.S. source, such as interest, dividends, & capital gains from U.S. securities, or Ough.S. property rental income, additionally be not prone to exclusion.

If you a somewhat more research or spend some precious time on IRS website, shortly come across with differing kinds of tax deductions and tax credit cards. Don't let ignorance make fresh more than you ought to paying.