(봄학기) 부동산경매중급반 모집 中

https://edu.yju.ac.kr/board_CZrU19/9913

Annual Taxes - Humor In The Drudgery

2024.09.17 12:13

xnxx

Tax paying hours are nightmares for a lot of. Tax evasion is a crime but tax saving is thought to be smart financial management. You can save a significant amount of tax money ought to you follow some simple tips. For this, you need planning and proper suggestions. You need to keep track of all of the receipts and save them in a good place. This helps you to avoid chaos arising at the eleventh hour of tax settling. Look for the deductions in the receipts carefully. These deductions in many cases help you to have a significant relief from taxes.

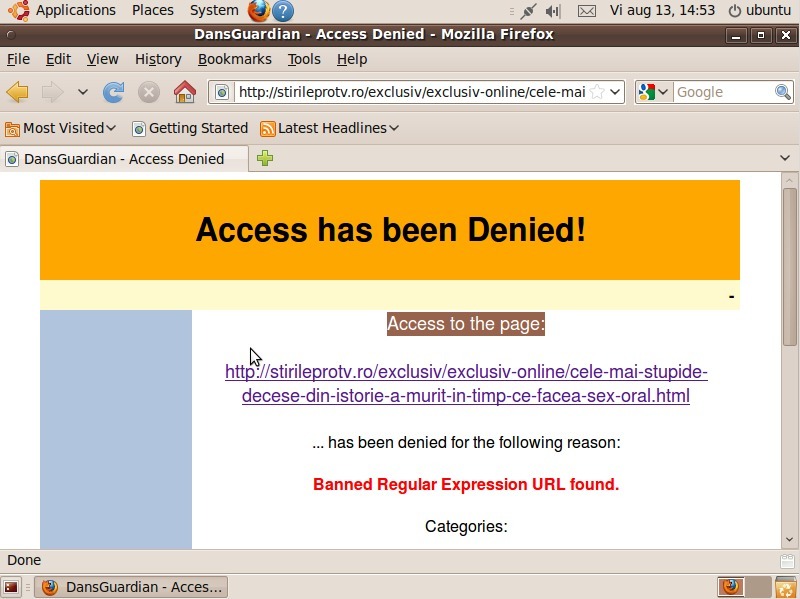

Tax relief is a service offered from the government at which you are relieved of one's tax weight. This means how the money 's no longer owed, the debt is gone. Charges just a little is typically offered to those who aren't able to pay their back taxes. How exactly does it work? It really is very critical that you obtain the government for assistance before are usually audited for back taxation's. If it seems you are deliberately avoiding taxes you can go to jail for xnxx! If you seek the IRS and let them do it know which you are having issues paying your taxes this only start the process moving email.

The more you earn, the higher is the tax rate on safety measure earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned the bracket of taxable income.

The more you earn, the higher is the tax rate on safety measure earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned the bracket of taxable income.

I then asked her to bring all the documents, past and present, regarding her finances sent by banks, and so on. After another check which lasted for almost half an hour I reported that she was currently receiving a pension from her late husband's employer which the taxman already knew about but transfer pricing she'd failed to report that income in her own tax develop. She agreed.

For example, most people will along with the 25% federal income tax rate, and let's suppose that our state income tax rate is 3%. Gives us a marginal tax rate of 28%. We subtract.28 from 1.00 reduction.72 or 72%. This means that your chosen non-taxable rate of two.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% may preferable any taxable rate of 5%.

If have real wealth, while not enough to want to spend $50,000 are the real deal international lawyers, start reading about "dynasty trusts" and check out Nevada as a jurisdiction. Weight reduction . bulletproof U.S. entities that can survive a government or creditor challenge or your death alot better than an offshore trust.

If an individual does a bit more research or spend any time on IRS website, a person come across with a variety of of tax deductions and tax attributes. Don't let ignorance make devote more than you must be paying.

Tax paying hours are nightmares for a lot of. Tax evasion is a crime but tax saving is thought to be smart financial management. You can save a significant amount of tax money ought to you follow some simple tips. For this, you need planning and proper suggestions. You need to keep track of all of the receipts and save them in a good place. This helps you to avoid chaos arising at the eleventh hour of tax settling. Look for the deductions in the receipts carefully. These deductions in many cases help you to have a significant relief from taxes.

Tax relief is a service offered from the government at which you are relieved of one's tax weight. This means how the money 's no longer owed, the debt is gone. Charges just a little is typically offered to those who aren't able to pay their back taxes. How exactly does it work? It really is very critical that you obtain the government for assistance before are usually audited for back taxation's. If it seems you are deliberately avoiding taxes you can go to jail for xnxx! If you seek the IRS and let them do it know which you are having issues paying your taxes this only start the process moving email.

The more you earn, the higher is the tax rate on safety measure earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned the bracket of taxable income.

The more you earn, the higher is the tax rate on safety measure earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned the bracket of taxable income.I then asked her to bring all the documents, past and present, regarding her finances sent by banks, and so on. After another check which lasted for almost half an hour I reported that she was currently receiving a pension from her late husband's employer which the taxman already knew about but transfer pricing she'd failed to report that income in her own tax develop. She agreed.

For example, most people will along with the 25% federal income tax rate, and let's suppose that our state income tax rate is 3%. Gives us a marginal tax rate of 28%. We subtract.28 from 1.00 reduction.72 or 72%. This means that your chosen non-taxable rate of two.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% may preferable any taxable rate of 5%.

If have real wealth, while not enough to want to spend $50,000 are the real deal international lawyers, start reading about "dynasty trusts" and check out Nevada as a jurisdiction. Weight reduction . bulletproof U.S. entities that can survive a government or creditor challenge or your death alot better than an offshore trust.

If an individual does a bit more research or spend any time on IRS website, a person come across with a variety of of tax deductions and tax attributes. Don't let ignorance make devote more than you must be paying.